The trend of China's ferrosilicon at the beginning of December 2022

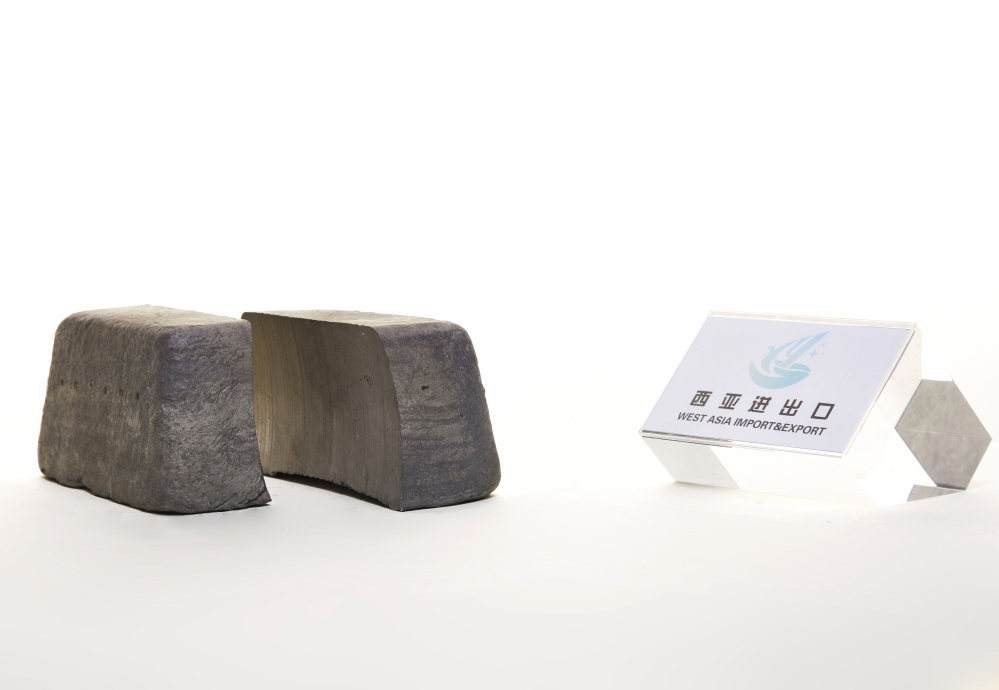

This week, HBIS Group confirmed that the bidding price of ferrosilicon 75 in December was US$1,260/ton, which was an increase of RMB 7/ton from last month, a little higher than market expectations. The spot market is still stable and the price is at a high point. In November, the national ferrosilicon output was close to 480,000 tons, which was an increase from October. At present, the supply side is stable, and the main production areas are resuming production, and some production areas have stopped production. The overall transaction situation of the market is average. Ferrosilicon futures began to decline at the beginning of the month, and then increased. For more information, please consult the West Asia Group.

In terms of downstream ferrosilicon, according to West Asia Group, the daily output of China's major steel enterprises was close to 2.03 million metric tons at the end of November. Compared with the previous small rate growth, the demand for winter reserves is not higher than in previous years, and the market mentality is too cautious. This week, as the futures went up, spot prices in some areas were slightly adjusted. However, considering the ability of the downstream to accept high prices, the West Asia Group predicted that the rise in steel prices will usher in a slow pace, and the short-term steel market is still unstable.

In the downstream magnesium market of ferrosilicon 75, the transaction rate of magnesium products has increased this week, but the demand is still not high. After the price rise, the downstream demand has further decreased. The mainstream ex-factory price of magnesium ingots in early December was around 3217 US dollars / metric ton.

West Asia Group will pay attention to the demand and follow up the transaction situation.