Silicon metal futures are close to listing, and the first new energy metal futures in China has attracted much attention

Silicon metal futures are approaching the market. Recently, the China Securities Regulatory Commission announced that it agreed to Guangzhou Futures Exchange to carry out metal silicon futures and options trading. This means that the first variety of Guangzhou Institute of Science and Technology is coming into the market.

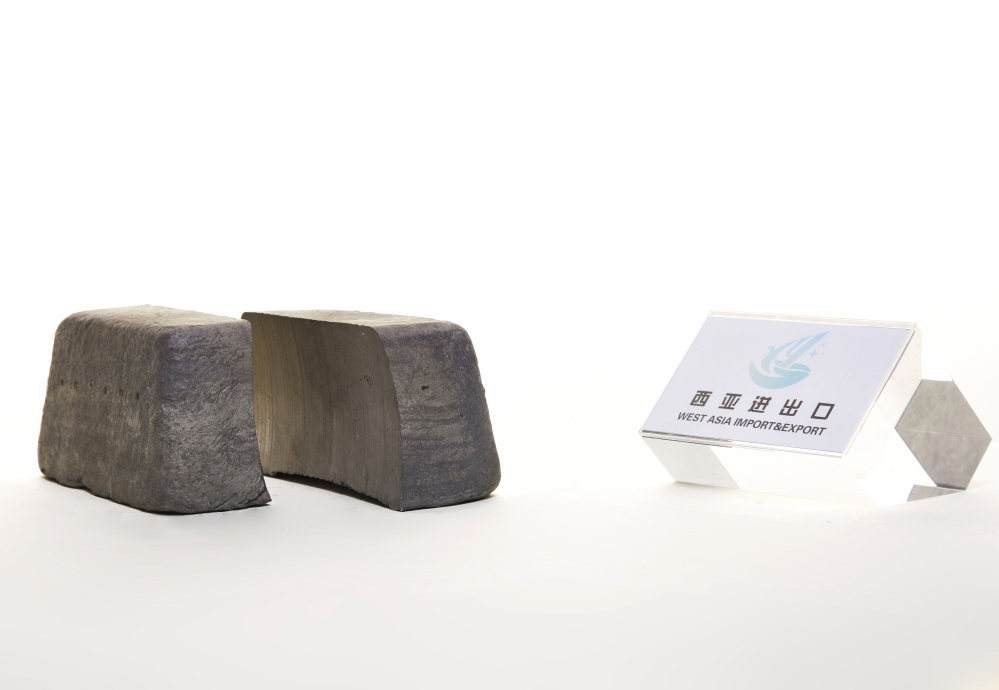

According to Hainan West Asia Group silicon metal is an important raw material for photovoltaic, semiconductor and other emerging industries. As an upstream link of polysilicon, the price of metal silicon fluctuates greatly in recent years. In this context, with the opening of metal silicon futures and options trading, upstream and downstream enterprises can lock profits and stabilize costs through hedging, which is also conducive to forming a metal silicon pricing center in China and enhancing the voice of metal silicon international pricing.

The CSRC said that, in the next step, it would urge Guangzhou Futures Exchange to make solid preparations for the listing of metal silicon futures and options to ensure a smooth launch and stable operation.

According to the survey data of Hainan West Asia Group, China is the world's largest producer and consumer of metal silicon. In 2021, China's metal silicon production capacity will be 4.99 million tons and the output will be 3.21 million tons, accounting for 79% and 78% of the global metal silicon production capacity and output respectively; The consumption of metal silicon is 3.132 million tons (including exports), of which the domestic consumption is 2.358 million tons, accounting for 56% of the total global consumption. According to the average price in 2021, the market size of metal silicon in China is about 64.4 billion yuan. Under the influence of the energy transformation and the "dual carbon" goal, it is estimated that the demand for metal silicon in China will reach 4.8 million tons in 2025, with a market scale of nearly 100 billion yuan.