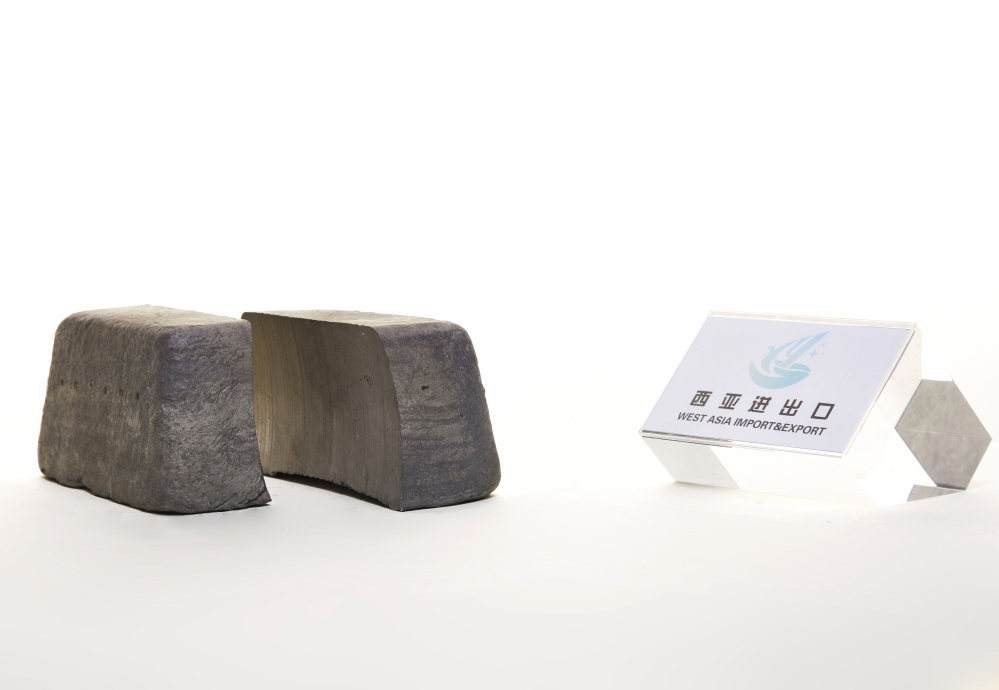

Weekly Dynamics of the Silicon Metal Market

The Silicon Metal prices in the Chinese market showed a slight upward trend at the beginning of this week, supported by tight supply in southern China. However, the prices stopped rising in the later part of the week due to sluggish demand and accumulated market inventory. As the holiday approaches, demand in the spot market remains limited.

Despite a small increase in prices in the Chinese domestic market this week, the export prices of Silicon Metal from China also experienced a slight rise, influenced by the tight domestic market. However, the overseas demand remained subdued during the holiday period, leading to stable prices in the latter part of the week.

In the Indian market, demand was sluggish during the holiday period, keeping Silicon Metal prices stable.

In the European market, there was minimal demand during the holiday period, but high production costs kept prices firm, resulting in a stable Silicon Metal market in Europe this week.

Market Dynamics:

>Chinese Domestic Market:

Due to reduced production in China Yunnan and Sichuan regions, the prices for Silicon Metal 5-5-3 increased by 200 CNY/MT to 14,800-15,100 CNY/MT.

Silicon Metal 3-3-03 prices rose by 100 CNY/MT to 15,900-16,200 CNY/MT.

Silicon Metal 2-2-02 prices remained stable at 17,500-18,500 CNY/MT.

>Chinese Offshore Market (2023-12-04 to 2023-12-29):

#553 Silicon Metal main export prices increased by 20 USD/MT to 2,120-2,170USD/MT at the beginning of the week but stabilized later due to limited export orders.

#441 Silicon Metal 4-4-1 export prices remained stable at 2,180-2,230 USD/MT.

#3303 Silicon Metal export prices also remained stable at 2,250-2,300 USD/MT.

#2202 Silicon Metal export prices stayed the same at 2,550-2,650 USD/MT.

>European Market (Tax-Inclusive) (2023-12-04 to 2023-12-29):

#553 remained stable at 2,150-2,250 EUR/MT.

#441 remained stable at 2,250-2,350 EUR/MT.

>Indian Market (2023-12-04 to 2023-12-29):

#553 mainstream transaction prices remained stable at 180-185 INR/KG.

#441 mainstream transaction prices also remained stable at 190-195 INR/KG.