China's silicon metal production cuts may expand

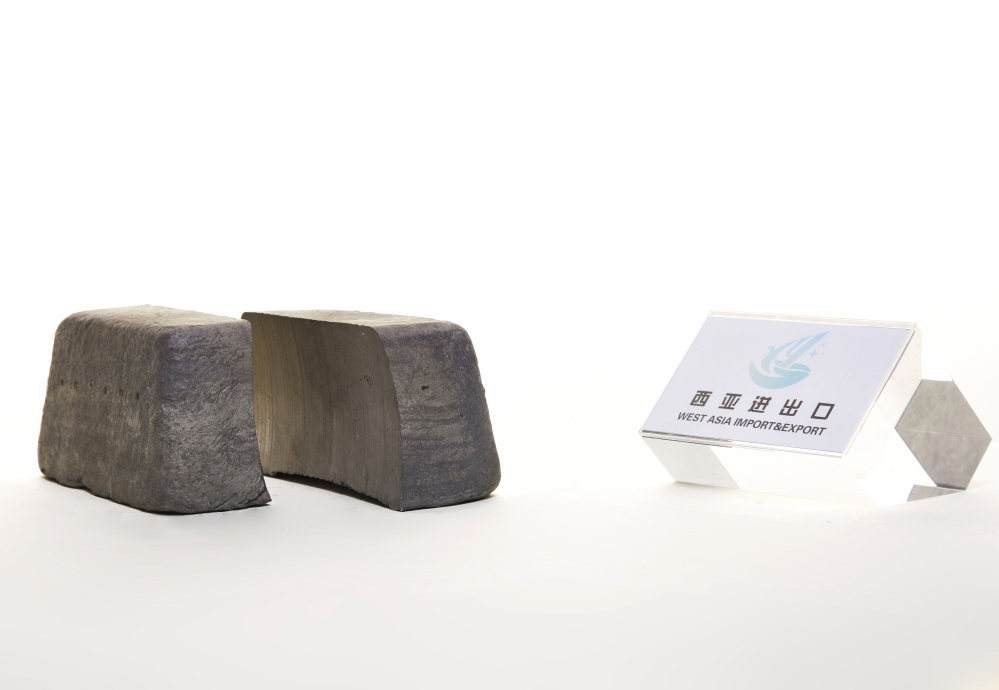

At present, in terms of metal silicon, the spot market price in China is stable and the market transactions are relatively average.

Looking at the market outlook, on the supply side, production capacity in China's northwest production areas has been steadily released, and the number of furnaces maintained at a high level. Costs in the southwest production areas have increased due to the dry season, and output has fallen. Some silicon plants have already reduced production, and the overall supply of metallic silicon is sufficient. On the demand side, the overall willingness of monomer manufacturers to raise prices is strong, and organic silicon prices are mainly rising. In terms of polysilicon, due to the imbalance of supply and demand in the photovoltaic component industry chain, silicon material storage has accumulated, and polysilicon prices have fallen; in terms of aluminum alloys, aluminum prices have fallen. The price of alloy ingots remains stable, downstream companies purchase on demand, and market transactions are limited.

Generally speaking, the current inventory of silicon metal remains high, and the situation of strong supply and weak demand has not improved significantly. It is expected that the price of metal silicon will be weak and stable in the short term. According to Hainan West Asia, although some silicon plants in southwest China were suspended due to power rationing in November, the actual impact was not large, and the scope of the shutdown is expected to be further expanded in December. In the later period, we will focus on production reduction in southwest production areas and downstream demand conditions.

For more information on ferroalloy price trends and market conditions, please contact Hainan West Asia Group.