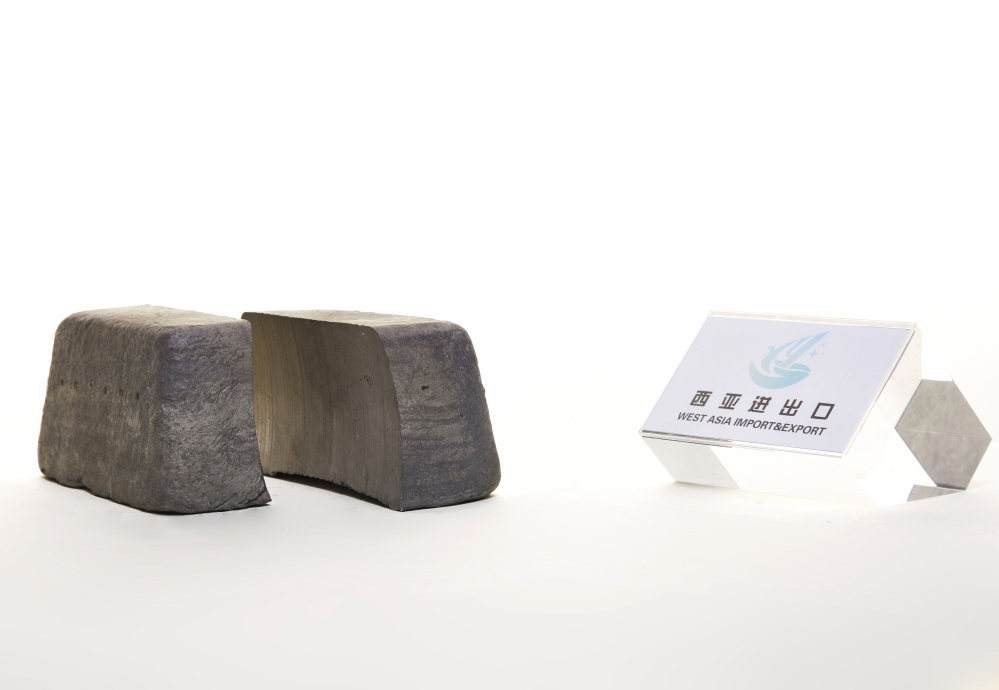

The demand in the ferroalloy market is poor, and there is competition at low prices. The market is in a state of chaos.

Hainan West Asia Group Co. analysed, the ferromanganese, the most common alloying additive in steel manufacturing, has continuously declined since the beginning of 2023. In particular, high-carbon ferromanganese, the price has been cut by almost 12%. Meanwhile, the buyer seems unsatisfied with it. Steel mills keep the bidding going, but the transaction goes downstream in general.

Poor market demand meets the low-price competition. The market is in a chaotic situation.

- The Post-pandemic Emotion

.png)

Since Covid-19 became a global pandemic, all industries have gone into slow motion: more cautious about investment, longer cargo delivery time, more beneficial advances, etc. Both the buyers and steel manufacturers are more hesitant while making decisions.

Also, due to the pandemic, people are more likely to cut their budgets and wait and see if there are substitute options, which is a part of the reason for low price competition: nobody wants to lose the bidding and profit. The situation is like two men reluctantly shaking their hands but unwilling to let go. It takes time to recover. The low price is not convincible for buyers to pay.

II.High Electricity Cost Narrow Down the Output

.png)

As one of the FeMn production land, India has a 5-10% increment in electricity bills which burdens the steel manufacturers even more to consume their local supply. Some resources told Hainan West Asia Group Co. India might see a 40 USD rise in electricity prices. The industrial power bills were unfriendly, as well as in China, which pressured the steel mills to cut their outputs.

The hiked electricity cost might be the theme for the year 2023. According to the Bureau of Labor Statistics, electricity bills rose from $0.147 per kWh to $0.168 per kWh compared with January 2022 and January 2023 and still going up, which results in steel mills putting aside the production than buying ferromanganese at a competitive market price.

III.Low Carbon Strategy Challenged the Steel Industry.

.png)

Decarbonization has become a priority subject for global industries since 190 nations adopted the Paris Agreement in 2015. Moreover, the challenge of carbon neutrality almost impacted 14-25% of steel companies if they failed to decrease carbon emissions. Manufacturers are seeking alternative raw materials, and developing new technology for production consumes a big part of their budgets. Besides, after the strike of coronavirus, nations that target to meet carbon neutrality before 2050 need to put much more effort, and the secondary industries are the first sector to suffer the impact.

For further information please contact Hainan West Asia Group Co.