The downstream consumption pattern is changing, and polysilicon has become the main force of consumption

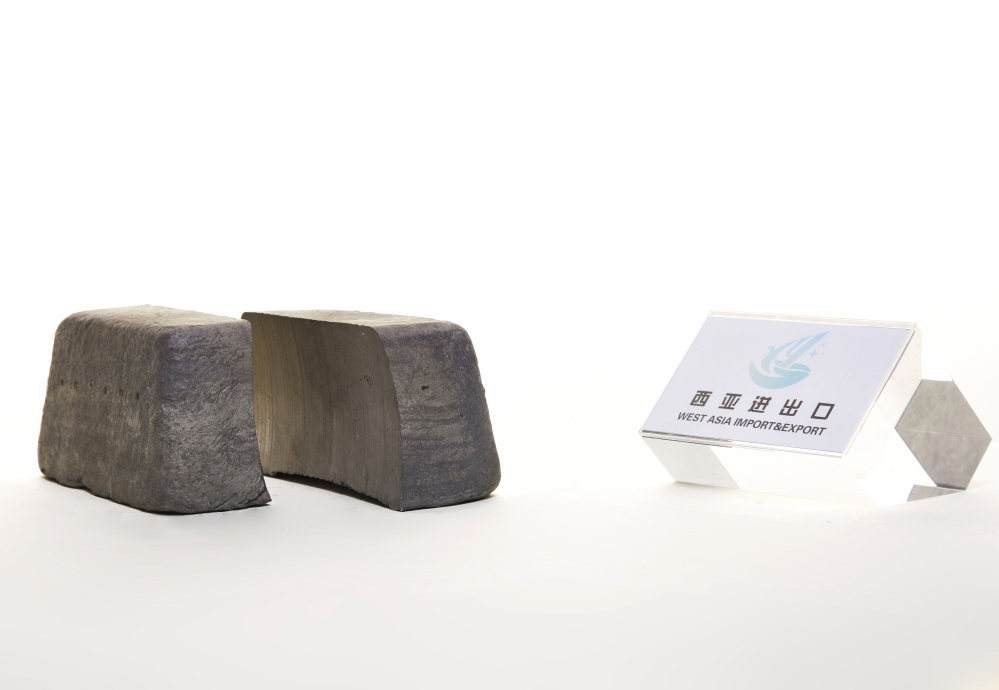

According to of Hainan West Asia Import and Export Company.In the past three years, the apparent consumption of industrial silicon in my country has shown a steady growth overall. Due to the effective control of the domestic new crown epidemic and the recovery of production, at the same time, the demand for downstream photovoltaic and organic silicon industries is strong. In 2022, the apparent consumption of industrial silicon in China will be 2.6491 million tons, a year-on-year increase of 31.40%. However, major overseas economies are in an interest rate hike cycle, and the overall macro pressure is relatively high. Therefore, my country's industrial silicon exports will be 651,000 tons in 2022, a year-on-year decrease of 16.30%.

.png)

In the downstream demand of industrial silicon, polysilicon, organic silicon and aluminum alloy consume a lot of industrial silicon. Among them, in 2022, polysilicon consumption of industrial silicon will reach 1.004 million tons, surpassing organic silicon to become the first consumption field, accounting for 39%, an increase of 9 percentage points from 2021; organic silicon consumption of industrial silicon is 924,000 tons, accounting for 36%. A decrease of 2 percentage points; aluminum alloys consumed 600,000 tons of industrial silicon, accounting for 23%, a decrease of 4 percentage points.

In terms of polysilicon, the market trend since 2022 can be roughly divided into four stages, the details are as follows:

.png)

(1) The first stage is from January to August 2022. At this stage, the overall performance of the photovoltaic industry chain is strong, the industry is in short supply, and the operating rate of polysilicon manufacturers continues to increase. At the same time, due to the sharp rise in international energy prices caused by the conflict between Russia and Ukraine, the imported silicon materials have been driven to run at a high level, superimposed on the production reduction and maintenance of individual production enterprises, the new production capacity of the polysilicon supply side is lower than expected, and the market price of polysilicon continues to rise. RMB 10,000/ton, increased to about 300,000 RMB/ton in August, an increase of more than 60% during the period;

(2) The second stage is from September to November 2022. At this stage, the photovoltaic industry maintains a high prosperity, and the production enthusiasm of polysilicon enterprises continues to increase. With the resumption of production by maintenance enterprises, the supply of polysilicon increases significantly. Under the state of both supply and demand in the industry , the market price of polysilicon remained high;

(3) The third stage is from December 2022 to January 2023. At this stage, the market price of polysilicon will show a sharp downward trend, and its price will fall sharply from a high of 300,000 yuan/ton to 150,000 yuan/ton, a drop of 50%. . The main reason for the price drop at this stage is that the new production capacity of production enterprises has been put into production one after another, leading enterprises have increased production, and the overall supply has increased compared with November. Affected by the delay of more photovoltaic terminal demand, the downstream demand is generally weak;

(4) The fourth stage is since February 2023. The price has rebounded from 150,000 yuan/ton to about 230,000 yuan/ton again, an increase of more than 50%. The start of the project, the strong expectation of downstream demand restoration, and the strong willingness to replenish the warehouse in the downstream of the industrial chain, once again pushed up the price of polysilicon. However, the current polysilicon price has begun to show signs of loosening. It is expected that with the release of polysilicon production, the market price will gradually return to a rational and reasonable range.

From the perspective of new installed capacity of terminal photovoltaics, domestic newly installed capacity will reach 87.41GW in 2022, an increase of 32.48GW (+59.13%) year-on-year. The domestic "dual carbon" strategic goal and Russia-Ukraine geopolitical events have pushed up energy costs in Europe. With the intensification of the foreign energy crisis, the development of photovoltaics has ushered in a golden period of development, and the trend of expansion of the European photovoltaic market will be long-term, and the importance of photovoltaics in future energy development will continue to increase.