Japan's Low Demand for Ferrochrome and Prices is stable

Due to sufficient inventory, the activity of Japanese chromium alloy consumers in the spot market remains at zero. However, suppliers are not in a hurry to lower their prices, and it is uncertain whether a lower price will attract buyers' interest.

India's high carbon ferrochromium (60% Cr; 6-8% C; 0.04% P max) bid for Japan was $1.17-1.22 per pound Cr CIF, unchanged from a week ago. Despite the lack of transactions in the local market and the downward trend in prices, Indian sellers are still in no hurry to make concessions for Japanese buyers. However, there has been no transaction so far.

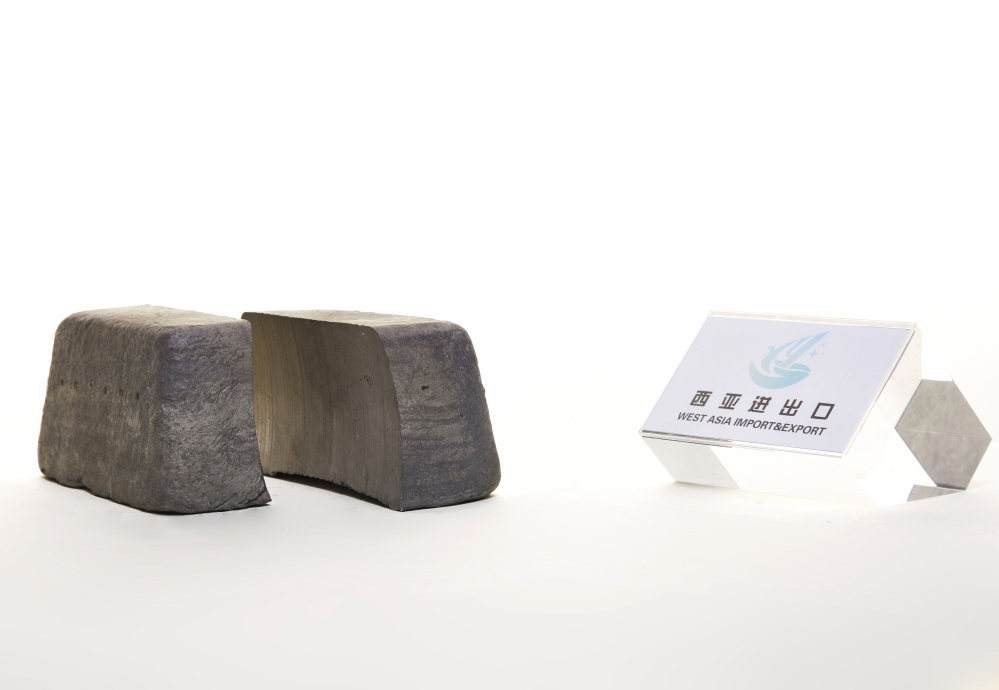

The quotation for low-carbon ferrochromium (60% Cr; 0.1% C) in China is currently stable. Despite insufficient demand, the main reason for the stable quotation is that the supplier stated that the minimum clearance for ferrochrome at the Chinese customs increased to 14.3%, while the export tariff remained at 40%. The quotation for Russian origin alloy is 2.65-2.68 USD/lb Cr CIF, and the buyer is not interested either.

Given the low level of business activity in the Japanese ferrochrome market, some non-traditional suppliers with inventory of Chinese materials have begun to enter the Japanese market, attempting to attract buyers with additional discounts. According to Hainan West Asia Group, South Korean traders have quoted a price of US $2.5-2.55 per pound Cr CIF for alloys originating in China, but there have been no reports of transactions yet.

A Japanese trader commented, “We currently do not need to purchase materials on site because we have a large amount of inventory purchased under long-term contracts.”