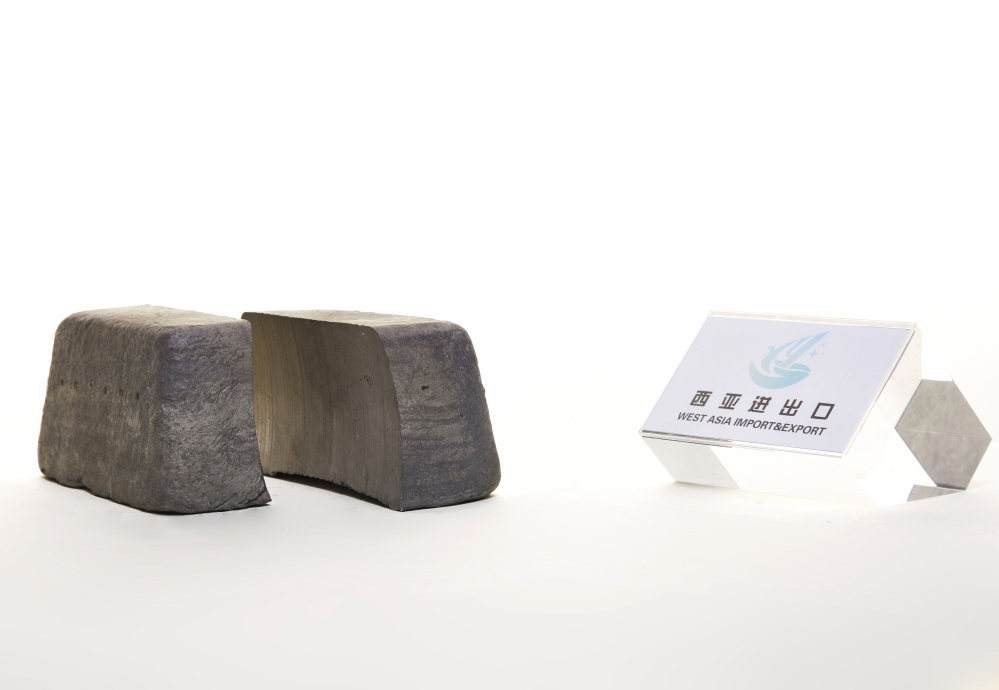

China's ferrosilicon market advantages

Ferrosilicon today morning market price in 72#7700-7900, 75#8200-8300 yuan/ton of cash natural block factory, 72# low price for bulk supply, the company is shipping Ningxia 10-50mm03-200, 10-60mm03-230; Handan 03+30, Hubei 03+100, Tianjin 03+50. Market transaction rhythm is still general, downstream pressure prices are obvious. In February, steel bidding is being promoted. East China Shagang, Zhongtian and Baosteel are all priced at 8,500 yuan/ton, Nangang opened the bid this afternoon, and Beihe Steel is not yet priced at 8,400 yuan/ton. The silicon iron market has many advantages: first, the price of electricity in producing areas rises, and the bottom support of cost moves up. Ningxia Zhongwei peak avoidance electricity price settlement is 0.47-0.49 yuan/KWH, Wuzhong full load electricity price is about 0.465 yuan/KWH. Qinghai peak avoidance electricity price 0.4 yuan/ton, full load electricity price 0.46-0.48 yuan/degree, electricity price rises in different degrees, cost upward. Second, the small furnace of Wuhai Big Plant in Inner Mongolia is about to be withdrawn, which is expected to affect the monthly output of 10,000 tons of ferrosilicon. Negative aspects: First, Australian coal imports resume, domestic coal prices began to decline, the decline is not obvious at present, but the decline of coal prices will lead to the expected reduction of power costs, coal will also fall, the cost support level of ferrosilicon will move down. Second, ferrosilicon supply will remain high. Even if the small furnace of Wuhai Junzheng Inner Mongolia exits the market, the monthly output of ferrosilicon will still maintain at the level of 500 thousand +. Analysts from Hainan Asia Import and Export Group pointed out that in general: the downstream demand for ferrosilicon has not fully recovered, the market turnover is not large, and the downstream manufacturers have an obvious attitude of lowering prices. Trade was modest on the export side, which fell as domestic prices fell and the exchange rate recovered. In the short term, there is support for the cost of ferrosilicon, spot is expected to hold a weak stable operation, in the long term, the need to pay attention to demand and coal price changes.